InOrder ERP Offers Sliding Royalty Scales to Adjust Rates Based on Sales

The InOrder ERP [Royalty Contract] window allows you to declare “contract clauses” that select line items that will earn royalties. For example, you can create a clause that pays 10% royalty on “Domestic sales with discount less than 40%” or “All Canada Sales.” InOrder also lets you group these clauses so you can simplify the clause selections. For example, you can have the following group of clauses “Discount greater than 40%,” “Domestic Sales,” and “Foreign Sales.” In this case, any sales with high discounts will pay royalty on the first clause in the group. Otherwise the sale will pay on one of the other two clauses. To illustrate the grouping feature, we can create another clause in a separate group, which earns 1% bonus royalty for any sales that occurred before a certain date. This royalty bonus could be computed on the same contract, next to the other calculation because it is in a separate group. Each clause can earn the author royalty based on a flat percentage / amount, or a sliding scale that adjusts the rate based on sales to date for this specific clause.

This function also allows sliding scales to adjust the rate based on sales to date across all clauses in the clause group, even if some of those clauses pay 0% royalty. This allows you to offer sliding scales that are based on all sales that meet selection criteria for any clause in that clause group, but only pay royalties on the sales selected by that clause itself.

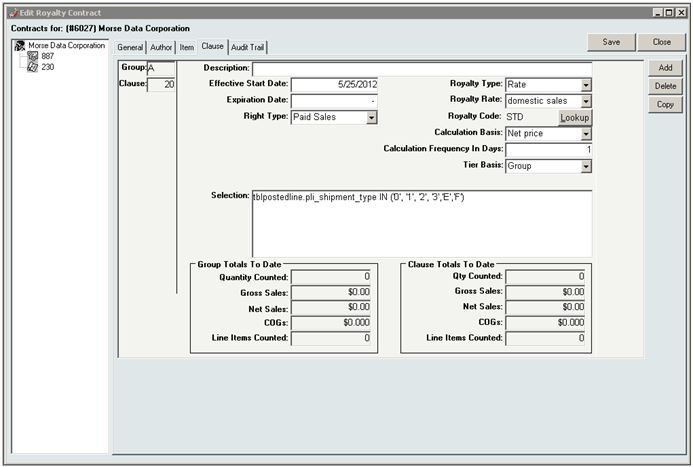

To use this feature, Set the Royalty Type to Rate and select the Tier Basis on the [Royalty Contract] Clause tab. The following selections are available:

- Clause – This selection calculates each clause independently.

- Group – This selection calculates all clauses in a clause group together, which means that sales for all classes in the clause group are used to jump to the next tier in the scale. For example, Group A contains two clauses, 10 and 20. Clause 10 pays x% up to 500 sold and y% over 500, but calculates only on sales in the US. Clause 20 pays X% up to 500 sold and Z% over 500, but calculates only on sales outside of the US. If 300 are sold in the US and 300 outside of the US, Clause 10 pays Y% and Clause 20 pays Z% because the total sold is over 500.

No Comments